July 9th, 2020

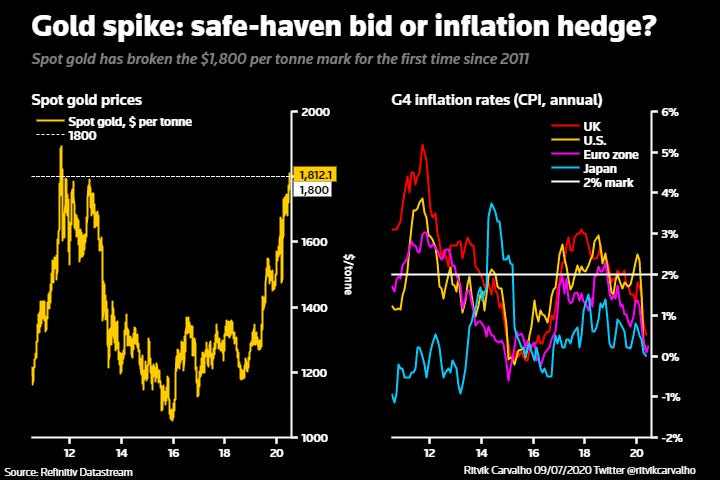

Spot gold broke the $1,800 mark for the first time since 2011 this week. The move is being interpreted in two ways. First, as a bid for safe-haven assets as daily new coronavirus cases continue to climb. Second, as a hedge against inflation and currency debasement as central banks and governments flood their economies with money (the UK just announced a $38 billion stimulus package to combat unemployment). Deutsche Bank points out U.S. money supply is up 25% year-on-year - according to them, this is only the tenth time in the past 190 years money supply is running above 20%. Still, inflation in the G4 group of economies remains well below the 2 percent mark their central banks have chased over the past few years.

Chart and commentary by Ritvik Carvalho

If you liked this, do consider subscribing. It’s free, and delivered to your inbox daily!