July 2nd, 2020

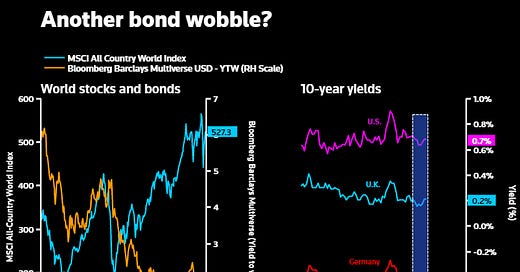

As the second half of a shocking 2020 gets underway and investors continue to bet on a sustained economic recovery over a pandemic relapse, government bonds have had another slight wobble and benchmark yields ticked higher this week. Part of that anxiety has been due to signs from the G4 central banks that they are reluctant to add to already massive, bond-buying stimulus programmes - the Fed has questioned the usefulness of explicit yield curve control, ECB officials have talked of being on pause while the recovery is assessed, and the Bank of England's chief economist Andy Haldane said the balance of risks has shifted. Whether signals or just noise, one implication is that onus will be more heavily on fiscal authorities to support the recovery while a useable vaccine is awaited.

Chart by Ritvik Carvalho and commentary by Mike Dolan

If you liked this, do consider subscribing. It’s free, and delivered to your inbox daily!