July 27th, 2020

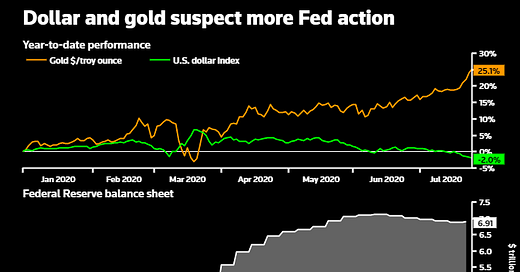

Even though the Fed's dramatic, pandemic-fighting balance sheet expansion peaked in June, markets are expecting the U.S. central bank to signal further easing measures ahead - possibly as soon as this week's policy meeting as Washington prepares to roll over fiscal support measures too. Along with persistent virus problems and rising political anxiety stateside, the fresh easing speculation has lifted gold to record highs as the dollar sinks further. Aiding gold's stellar run is speculation the Fed will indicate plans to cap Treasury yields while at the same time balking at negative interest rates - something likely to crush Treasury volatility for the foreseeable future and see investors seeking bond alternatives like gold to balance equity portfolios.

Chart by Ritvik Carvalho and commentary by Mike Dolan.

If you liked this, do consider subscribing. It’s free, and delivered to your inbox daily!