July 24th, 2020

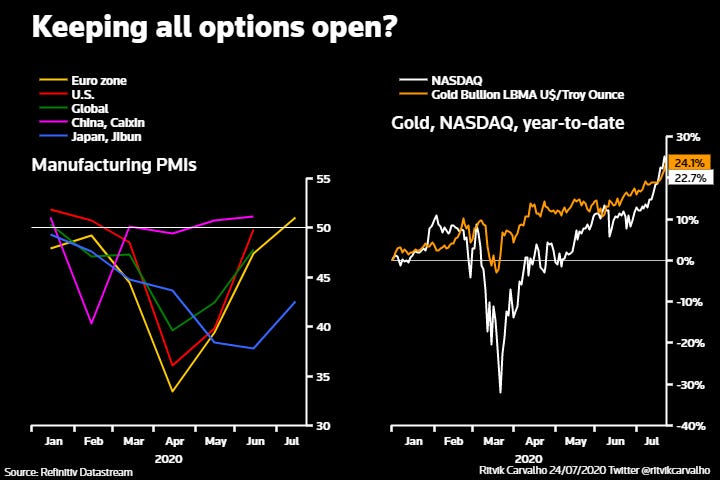

As European business surveys suggest the recovery from the pandemic shock is indeed tracking the "V" that markets have been betting on, both extremes of investment risk appetite appear to be gaining in tandem - with gold's surge to 9-year highs matching the march of the equity market's tech-sector vanguard to records on the Nasdaq -- even as implied volatility and demand for options protection subsides. Are fund managers simply replacing near-zero yield government debt with other portfolio balancers like gold, the yen and Swiss francs? Or is anxiety about a stimulus-driven, inflationary return to robust growth in a digital future the only way to square the circle?

Chart by Ritvik Carvalho and commentary by Mike Dolan.

If you liked this, do consider subscribing. It’s free, and delivered to your inbox daily!