July 16th, 2020

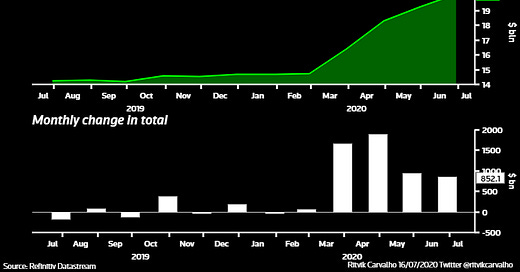

A recent slowing down in the growth of central bank balance sheets, along with what Deutsche Bank terms upcoming “benefits” cliffs in the U.S. (and other major economies) later this month has investors worried about potential market ructions and economic damage that could take place as a result. Jim Leaviss of M&G’s Investments’ Bond Vigilantes blog says the withdrawal of furlough schemes in developed markets could well provoke the new ‘taper tantrum’. The cresting of this “first wave” of monetary and fiscal stimulus comes at a time of a resurgence in COVID-19 cases worldwide, and threatens to strangle what many assumed would be a quick, ‘V’-shaped economic recovery.

Chart and commentary by Ritvik Carvalho

If you liked this, do consider subscribing! It’s free, and delivered to your inbox daily!