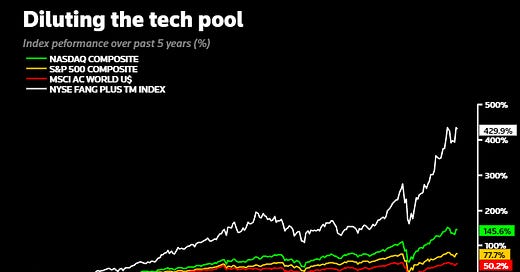

So-called 'concentration risk' has been a fact of life for stock investors all year as the soaring market capitalization of leading technology firms swamps supposedly diversified equity benchmark indices. Their dominance has been amplified by the pandemic. Although these stocks are considered to be the vanguard of the digital economy and the latest industrial revolution, analysts fear they are especially prone to numerous risks from antitrust backlashes, 'normalisation' of economies after a pandemic vaccine next year and even higher interest rates down the road. Ahead of an expected Democrat sweep in next month's U.S. elections, a House of Representatives panel report this week detailed how the four big technology firms - Apple, Facebook, Google and Amazon - engaged in anti-competitive practices. But the remedies outlined stopped short of calling for a break up of the firms. And September's relative wobble in tech stocks was brief and has calmed since. While the urge to diversify may be building after such stellar gains - stock markets have frequently been driven by a few dominant sectors and stocks in the past and some investors reckon the phenomenon could survive periodic shakeouts.

Chart by Ritvik Carvalho and commentary by Mike Dolan

If you liked this, do consider subscribing. It’s free, and delivered to your inbox daily!