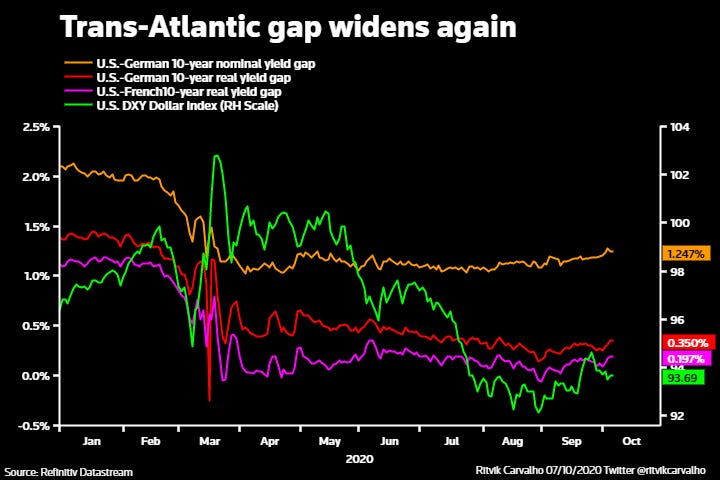

The dollar has held up well over the past month as the US election approaches, with currency markets seemingly unperturbed by a widening opinion poll lead for Democrats and betting markets placing 60-70% chance of a clean sweep of the White House and both houses of Congress. Some analysts say the dollar is behaving like a 'safety' play, though there's also a chance a Dem-led increase in fiscal spending next year will take pressure off the Fed to double down on its monetary stimulus (even if it keeps borrowing rates from rising sharply). The opposite is true in Europe, where markets now expect the ECB to have to up its bond buying by yearend. As a result, the nominal and real 10-year yield premium on U.S. debt over the euro zone has widened again to 6-month and 2-month highs respectively - providing support for the greenback.

Chart by Ritvik Carvalho and commentary by Mike Dolan

If you liked this, do consider subscribing. It’s free, and delivered to your inbox daily!