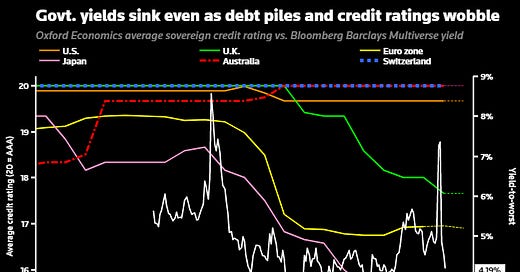

U.S. Treasury bond markets barely flinched as Fitch Ratings lowered the outlook on its AAA U.S. Treasury credit rating to negative, with the dollar seemingly taking the heat from the decline in long-term U.S. real yields to -1% as the Fed keeps a lid on U.S. government borrowing rates. The picture of declining yields even in the face of rising debt-GDP levels and ebbing credit ratings has been a feature of other G7 economies in Japan and Europe for years as central banks intervene continually to buy government bonds and cap borrowing rates with inflation missing in action - aping the basic tenets of the much-debated Modern Monetary Theory.

Chart by Ritvik Carvalho and commentary by Mike Dolan.

If you liked this, do consider subscribing. It’s free, and delivered to your inbox daily!