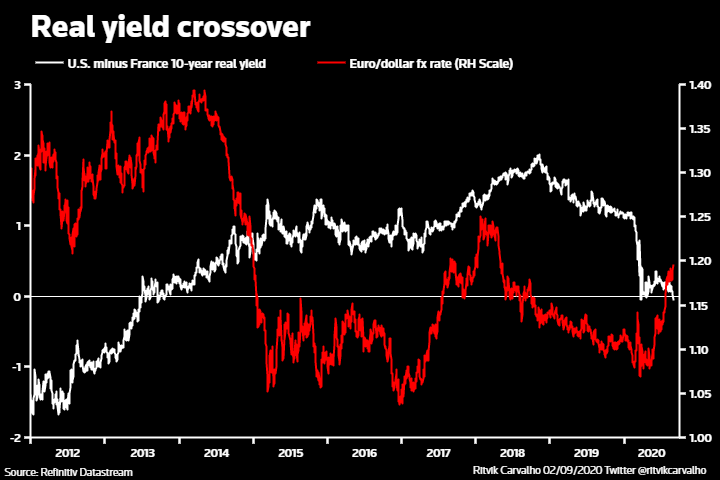

As the euro zone flirts again with monthly deflation prints, U.S. 10-year 'real', or inflation-adjusted, yields have fallen back below euro zone equivalents. The premium on the benchmark French 10-year OATi over the U.S. 10-year TIP is now bigger than it's been in 7 years. The evaporation of the Transatlantic real yield gap helped lift euro/dollar above $1.20 briefly on Tuesday for the first time in more than 2 years - with some wondering if European Central Bank will start to worry about a vicious circle of deflation fears and further euro strength. The ECB meets again on Sept 10.

Chart by Ritvik Carvalho and commentary by Mike Dolan.

If you liked this, do consider subscribing. It’s free, and delivered to your inbox daily!