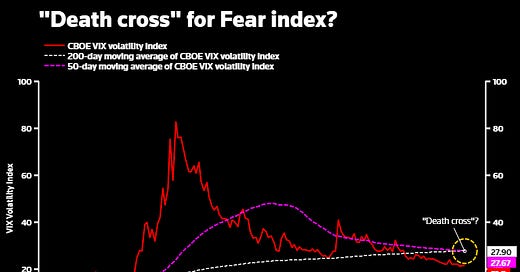

Although the S&P500 stock index topped Feb 20's record high on Tuesday, 30-day implied volatility of the index measured by the VIX - or 'Fear Index' - is still some 5 percentage points higher than it was 6 months ago just before the pandemic shock unfolded. While that may be unsurprising given the dramatic roller-coaster ride in the interim, deep recession and huge virus-related uncertainties, the VIX is less than a quarter of its March peak and technical signals spotlight a so-called "Death Cross" where its 50-day moving average is breaking below the 200-day equivalent - often a sign of further sharp declines when triggered in other markets.

Chart by Ritvik Carvalho and commentary by Mike Dolan.

If you liked this, do consider subscribing. It’s free, and delivered to your inbox daily!