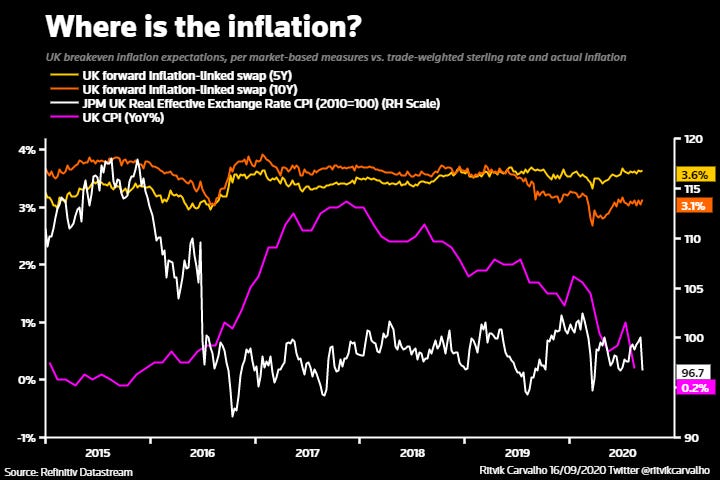

August’s print of the UK’s consumer price index showed inflation tracking at 0.2%, its lowest rate in almost five years. The fall came due to a big drop in meal prices - helped by the government’s “Eat Out to Help Out” scheme which was aimed at supporting Britain’s hospitality sector. The pandemic’s shock to the economy and a coming surge in unemployment will likely keep inflation in check. Still, market expectations for future inflation - as shown by UK breakeven inflation rates - have risen in recent weeks, and are tracking above the 3% mark, possibly explained by the weakness in the pound, and expectations that government stimulus programmes will eventually aid reflation. Whatever the explanation, an extended inflation undershoot could prompt the UK government to rethink the 2% inflation target which it sets for the Bank of England. Today’s Federal Reserve meeting will be the U.S. central bank’s first under a newly adopted framework that promises to shoot for inflation above 2% to make up for periods, such as now, where it is running below that target.

Chart and commentary by Ritvik Carvalho

If you liked this, do consider subscribing. It’s free, and delivered to your inbox daily!