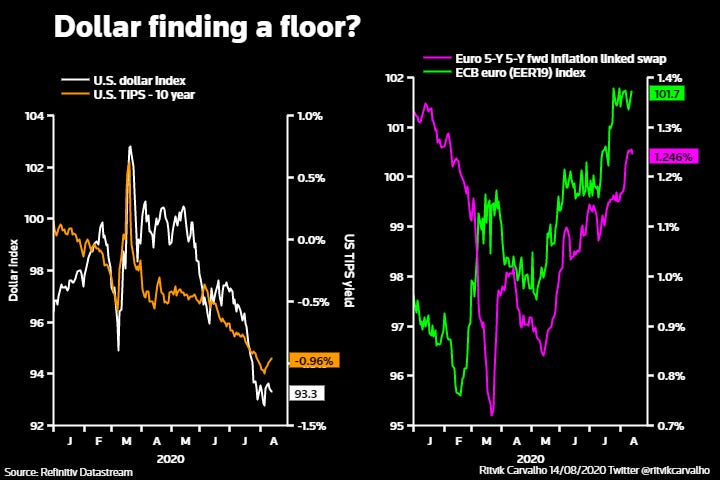

By some measures, this has been the most sustained dollar decline in a decade - with the collapse in U.S. real yields below -1.0% and pre-election jitters dogging the greenback while relative virus trends and post-lockdown recoveries in Europe saw an easing of deflation fears in the euro zone. Using Refinitiv's =USD dollar index against the most-traded world currencies, the dollar has clocked up 8 weeks of consecutive losses for the first time since 2010. But despite the milestone, there were signs of the dollar finding its footing. A backup in U.S. bond yields this week amid a record deluge of new debt sales, some spiky core inflation data and tightening pandemic restrictions around the world may have stalled the elongated dollar decline for now.

Chart by Ritvik Carvalho and commentary by Mike Dolan.

If you liked this, do consider subscribing. It’s free, and delivered to your inbox daily!